Application of customs regime 42 in France

- Evguenia Derviankine

- 15 February 2026

En bref

The rules for using the 42 regime have just been changed. Established and non-established importers should familiarize themselves with the new requirements.

Customs regime 42 is a mechanism allowing the optimization of import VAT where the imported goods are not intended to be released for consumption in the Member State of importation, but in another Member State. Recent regulatory changes have modified the way it is used in France, particularly for companies not established in the EU. Furthermore, discussions are underway regarding its possible integration into the ‘international representative’ mechanism.

- I. What is Customs regime 42?

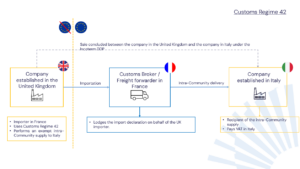

Customs regime 42 is a mechanism allowing goods to be imported and released for free circulation with an exemption from import VAT, provided that the goods are intended to be subject to an intra-Community supply immediately following their importation. In France, the tax aspects of this mechanism are covered in Article 291(III)(4) of the French General Tax Code (“Code général des impôts” or “CGI”).

Under Customs regime 42, VAT is not payable at the time of importation, nor in the Member State of import. Instead, VAT is paid by the final consignee of the goods in the Member State of destination, in accordance with the rules applicable in that State. In this respect, Customs regime 42 represents an alternative to the customs transit procedure.

Although easier to operate than a transit procedure, Customs regime 42 is also subject to strict conditions. To apply, the intra-Community supply must take place immediately after importation. The imported goods must therefore be sent to the Member State of destination without any delay other than those strictly necessary for transshipment operations (loading, unloading, movement, packaging or repackaging).

The conditions for applying Customs regime 42 are specified in Article 96 P of Annex II to the French General Tax Code .

On the customs declaration, Customs regime 42 must be indicated in the “additional fiscal reference” data field, by indicating:

– the VAT number of the importer carrying out the exempt intra-Community supply, or that of its fiscal representative/agent (format: FR7 + VAT number of the importer/representative/agent), followed by

– the VAT number of the recipient carrying out the intra-Community acquisition (format: FR2 + VAT number of the recipient in the Member State of destination)[1]

.

[1] The data may vary if the office where the goods are presented is not located in France. The special code G6030 must also be entered, certifying that the transaction complies with the requirements of Article 291(III)(4) of the French General Tax Code .

The invoices supporting the transaction must include the same VAT numbers, as well as the wording: “VAT exemption – Article 262 ter I of the French General Tax Code.” They must also indicate the name and VAT number of the fiscal representative, if any, as well as the mandatory information referred to in Article 242 nonies A of Appendix II to the CGI .

Widely used in the post-Brexit context, this mechanism enabled UK companies to maintain DDP (Delivered Duty Paid) Incoterms with their EU customers without having to bear the administrative burden associated with VAT registration in France, the country of entry of their goods into the EU.

According to European Commission estimates, approximately EUR 221.8 billion worth of goods benefited from Customs regime 42 within the EU between 2021 and 2023 (European Court of Auditors, 2025[1] ).

- II. Use of Customs regime 42 by importers not established in the EU

Until December 31, 2025, importers established in a third country that carried out transactions exempt from VAT pursuant to Article 291(III)(4) of the French General Tax Code could use ad-hoc tax representation (“représentation fiscale ponctuelle”) to import goods into France under this regime. This mechanism allowed them to avoid registering for VAT in France.

The French Finance Act for 2024 put an end to this possibility, with implementation postponed until January 1, 2026 (tax ruling of May 14, 2025, BOI-RES-TVA-000207 ).

Since 1 January 2026, the situation of non-EU importers wishing to use Customs regime 42 depends on whether their country of establishment has concluded a mutual assistance agreement for the recovery of tax claims with France[1] .

II.1. Importers established in a third country that has not concluded a mutual assistance agreement for the recovery of tax claims with France

To use Customs regime 42 when importing into France, importers established in a third country that has not concluded a mutual assistance agreement for the recovery of tax claims with France, must appoint a permanent fiscal representative in France (“représentant fiscal permanent “)[1] . A permanent fiscal representative is a person established in France who has been accredited by the French authorities to carry out fiscal representation activities (see BOI-TVA-DECLA-20-30-40-10 §140 et seq. regarding accreditation requirements). The fiscal representative will register the importer for VAT purposes in France and will assume the related accounting and reporting obligations, including:

- Issuing invoices;

- Keeping accounting records and/or presenting them to the tax authorities upon first request;

- Filing VAT declarations reporting all exempt intra-Community supplies carried out under Article 262 ter I of the French General Tax Code;

- Filing recapitulative statements of recipients of those supplies as provided for under Article 289 B of the French General Tax Code.

II.2. Importers established in a third country that has concluded a mutual assistance agreement for the recovery of tax claims with France

To use Customs regime 42, importers established in a third country, that has concluded a mutual assistance agreement for the recovery of tax claims with France, must register for VAT in France with the Tax Department for Non-Residents and declare their transactions to it on a regular basis (Article 289 A of the General Tax Code; I of Article 95 of Appendix III to the French General Tax Code ).

They may also delegate their reporting obligations to a permanent fiscal agent (“mandataire fiscal permanent »), who will file VAT declarations on their behalf (Article 95(III) of Annex III of the French General Tax Code ). Unlike a permanent fiscal representative, the permanent fiscal agent acts under the responsibility of the principal, which remains solely liable for VAT in the event of non-compliance with its exemption conditions or other errors and omissions (BOI-TVA-DECLA-20-30-40-20 §§10–40 ).

III. Use of Customs regime 42 by importers established in the EU

To use Customs regime 42 for imports into France, EU-established operators must either:

- register for VAT in France with the Tax Department for Non-Residents and file VAT declarations themselves (Article 289 A; Article 95(I) of Annex III of the French General Tax Code), or appoint a permanent fiscal agent (“mandataire fiscal permanent ») (Article 95(III) of Annex III of the French General Tax Code);

- or appoint an ad-hoc fiscal agent (“mandataire fiscal ponctuel ») responsible for fulfilling reporting obligations on their behalf (Article 95 B(I) of Annex III of the French General Tax Code), without being required to register for VAT in France. This option is not available to importers already registered for VAT in France.

- IV. “International representative” mechanism, currently not applicable to regime 42

IV.1. Presentation of the mechanism

Article 289 A bis of the French General Tax Code introduced a new type of tax representation mandate – “international representative” – applicable from January 1, 2025.

This mandate allows taxpayers who are not established in France, regardless of their country of establishment, and who are not registered for VAT in France, to entrust all their VAT reporting and payment obligations to an “international representative” established in France, provided that the latter has physical control of the goods under a specific contract (contract for consignment sale, workmanship, assembly, manufacturing, rental, storage, or transit of goods to a territory other than France).

In accordance with the provisions of Article 95 ter of Annex III to the CGI, this mechanism is only applicable when taxable persons not established in France exclusively carry out the following transactions:

- Imports for which VAT is fully deductible, within the meaning of II of Article 271 of the CGI;

- Deliveries exempt under Article 262 of the CGI, in particular exports of goods carried out by the seller or by the buyer not established in France;

- Transactions involving the removal of goods from a customs import suspension regime or a tax warehouse, exempt from VAT pursuant to 11-4-1° of Article 277 A of the CGI, where these goods are exported immediately after their removal ;

- Exempted releases for consumption of goods placed under a customs import suspension arrangement that have been subject to one or more deliveries while under that arrangement.

The use of an “international representative” allows importers not established in France, regardless of their country of establishment, to simplify their import reporting obligations while retaining their right to deduct VAT paid on imports.

IV.2. Explicit exclusion of regime 42 from this mechanism

Customs regimes 42 and 63 are excluded from the scope of the “international representative.” Thus, an operator not established in France who imports goods under regime 42 cannot entrust their VAT obligations to an “international representative” and has no other options than those referred to in II and III above.

IV.3. Launch of a public consultation on the possible inclusion of this regime in the mechanism

On February 11, 2026, the administration launched a public consultation on the new systems with the aim of gathering practitioners’ opinions on their application.

This could be seen as an opportunity to argue for the inclusion of regime 42 within the scope of the “international representative”. Professionals can submit their comments until March 31, 2026, to the following address: bureau.d1-dlf@dgfp.finances.gouv.fr .

Such an extension would be welcome, for at least three reasons:

- Harmonization of the rules for non-established operators: From an operational point of view, a non-established operator who imports goods for re-export outside the EU and one who imports them for delivery in another Member State are in a similar situation since in both cases no French VAT should be collected. However, the former can benefit from the international representative, while the latter must register

- Exemption from registration in France for non-established companies: Non-established companies that use an “international representative” are exempt from VAT registration in France for transactions covered by the mandate. However, this exemption only applies to eligible transactions. If the operator carries out other taxable transactions in France, it must then register for VAT in France.

- A competitiveness issue: at a time when European countries are competing to attract logistics flows, the ease of administrative formalities is a determining factor. A regime that is difficult to access due to VAT registration in France would not enhance the attractiveness of French entry points compared to other Member States.

-

- V. Regime 40 : Alternative to Customs regime 42

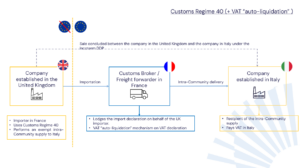

The end of ad-hoc fiscal representation (“représentation fiscale ponctuelleé) as of 1 January 2026 makes Customs regime 42 less attractive for businesses not established in the EU, as it leaves them with no alternative but to register for VAT in France. Once registered for VAT in France, such businesses may also rely on Customs Procedure 40 and VAT “auto-liquidation” mechanism. Since this mechanism has been in place in France, VAT on imports is no longer payable when the import declaration is submitted but must simply be reported as ‘VAT due’ and, at the same time, as ‘VAT deductible’ (if recoverable) on the periodic VAT declaration, which allows its neutralisation.

By Evguenia DEREVIANKINE , founding partner,

and Matthieu LEVASSEUR , legal assistant.

February 16, 2026

[1] The data may vary if the office where the goods are presented is not located in France.

[2] European Court of Auditors (2025), Value added tax fraud on imports (p.12)

[3] Listed in the decree of May 15, 2013 establishing the list of non-member countries of the European Union with which France has a legal instrument relating to mutual assistance with a scope similar to that provided for by Council Directive 2010/24/EU of March 16, 2010 and Regulation No. 904/2010 of October 7, 2010.